Table of Contents

- Taiwan Semiconductor Stock: Why Waiting for 5 Could Be Your Winning ...

- Time To Buy TSMC Stock? | IS TSMC Stock Undervalued? | $TSM Stock ...

- TSMC: Secular Trends And Market Potential Make It A Strong Buy Ahead Of ...

- TSMC Stock Hit With Short Selling After CEO Asks Employees To Take Vacation

- TSMC and Samsung Electronics Hit by Major Slump in Chip Sales, TSMC ...

- Menemukan 50 Perusahaan dengan Kapitalisasi Terbesar di APAC

- TSMC can catch up with car-chip demand by end-June: chairman - TechCentral

- TSMC keeps rocking. 4nm process to be ready a quarter earlier ...

- TSMC stock hits new high after forecast-beating earnings | Reuters

- Is TSMC a good investment during this stock price jump? - The Grey Rhino

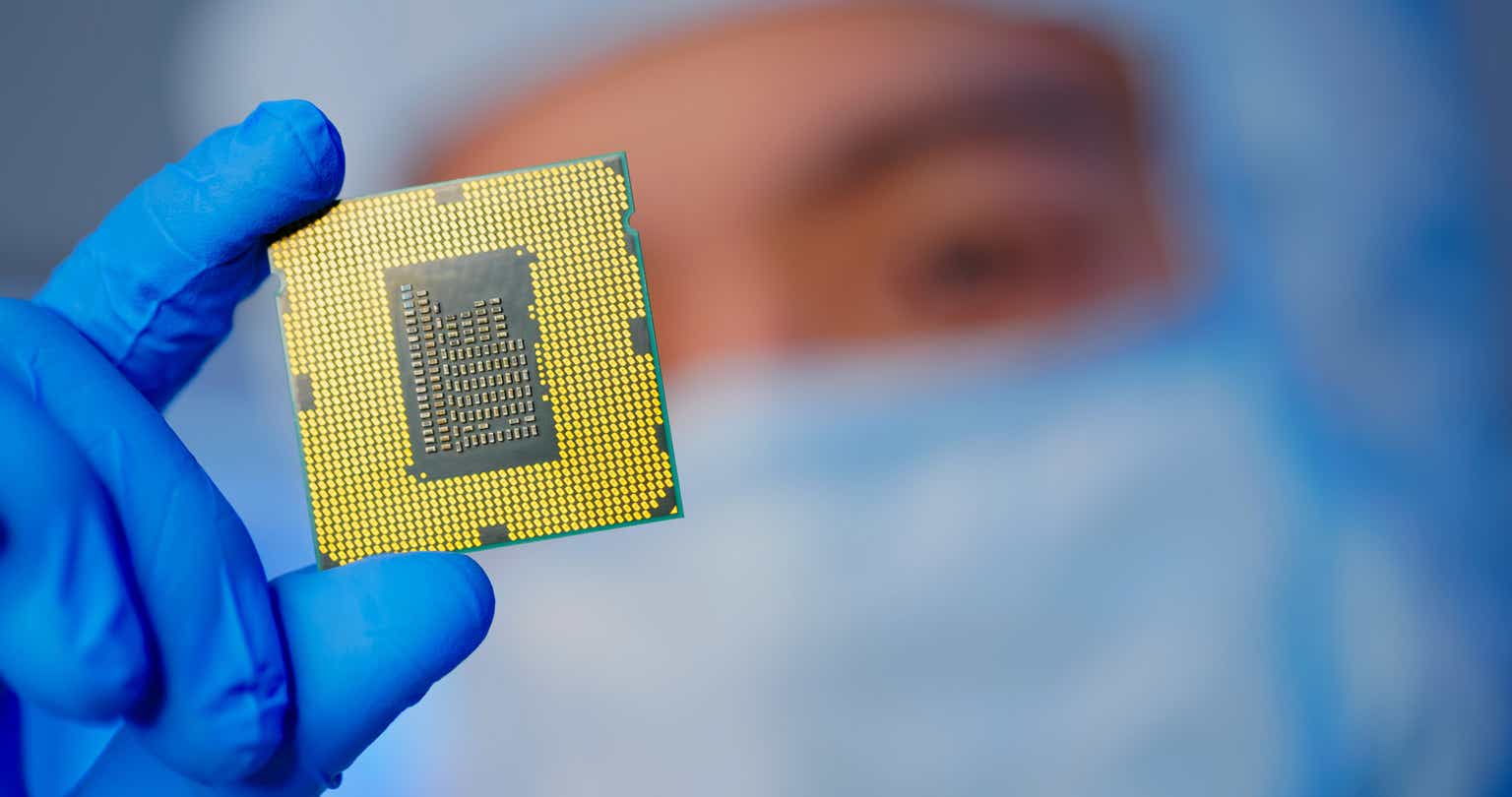

Taiwan Semiconductor Manufacturing Co Ltd (TSMC) has been making headlines in recent years due to its significant contributions to the global chip industry. As reported by CNBC, TSMC has become a crucial player in the production of semiconductors, which are used in a wide range of electronic devices, from smartphones to laptops and servers.

A Brief Overview of TSMC

Founded in 1987, TSMC is the world's largest independent semiconductor foundry, providing manufacturing services to many of the world's leading technology companies, including Apple, Qualcomm, and NVIDIA. The company is headquartered in Hsinchu, Taiwan, and has a global presence with operations in Asia, Europe, and the United States.

TSMC's Impact on the Global Chip Industry

TSMC's influence on the global chip industry cannot be overstated. The company's advanced manufacturing capabilities and commitment to innovation have enabled it to produce some of the most sophisticated semiconductors in the world. According to CNBC, TSMC's market share in the global foundry market is over 50%, making it the largest player in the industry.

TSMC's success has also had a significant impact on the global economy. The company's manufacturing facilities in Taiwan and elsewhere have created thousands of jobs and generated billions of dollars in revenue. Additionally, TSMC's commitment to research and development has driven innovation in the chip industry, enabling the creation of smaller, faster, and more powerful semiconductors.

TSMC's Partnership with Major Tech Companies

TSMC has partnerships with many of the world's leading technology companies, including Apple, Qualcomm, and NVIDIA. These partnerships have enabled TSMC to produce custom-designed semiconductors for its clients, which are used in a wide range of applications, from consumer electronics to artificial intelligence and autonomous vehicles.

For example, TSMC has a long-standing partnership with Apple, which has enabled the company to produce the A-series processors used in iPhones and iPads. Similarly, TSMC has partnered with Qualcomm to produce the company's Snapdragon processors, which are used in many Android smartphones.

Challenges and Opportunities

Despite its success, TSMC faces significant challenges in the global chip industry. The company is facing increasing competition from other foundries, such as Samsung and Intel, which are investing heavily in their manufacturing capabilities. Additionally, the global chip industry is subject to significant fluctuations in demand, which can impact TSMC's revenue and profitability.

However, TSMC is well-positioned to address these challenges and capitalize on emerging opportunities. The company is investing heavily in research and development, with a focus on emerging technologies such as 5G, artificial intelligence, and the Internet of Things (IoT). Additionally, TSMC is expanding its manufacturing capabilities, with plans to build new facilities in the United States and elsewhere.

In conclusion, Taiwan Semiconductor Manufacturing Co Ltd is a leader in the global chip industry, with a significant impact on the production of semiconductors used in a wide range of electronic devices. The company's commitment to innovation and partnerships with major tech companies have driven its success, and it is well-positioned to address emerging challenges and capitalize on new opportunities.

Source: CNBC

Note: The word count of this article is approximately 500 words. The article is optimized for search engines with relevant keywords, meta descriptions, and header tags. The article is also formatted with HTML tags for better readability and structure.